SUITE 200, 1920 YONGE STREET

TORONTO, ONTARIO, CANADA M4S 3E2

(416) 847-6898

PROXY STATEMENT

2025 ANNUAL MEETING OF SHAREHOLDERS

To Be Held on June 12, 2025

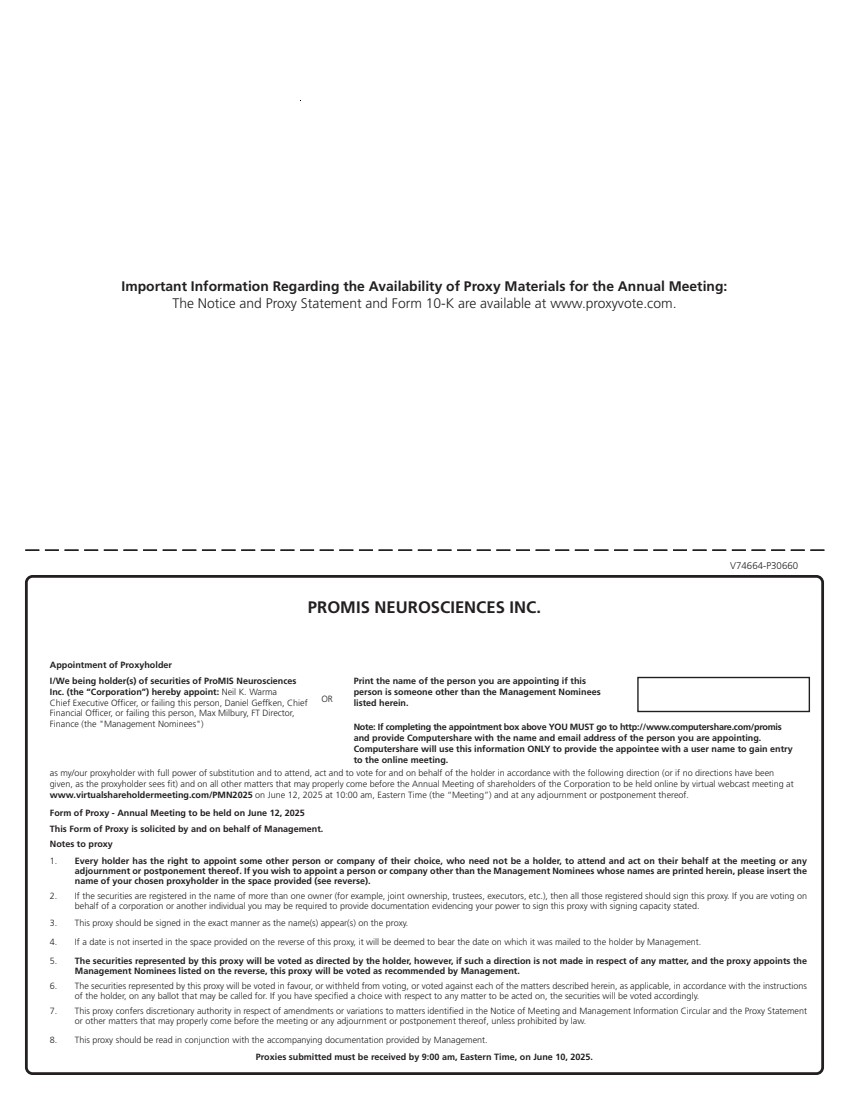

This proxy statement contains information about the 2025 Annual Meeting of Shareholders of ProMIS Neurosciences Inc. (the “Annual Meeting”), to be held on Thursday, June 12, 2025 at 10:00 a.m., Eastern Time. This year’s Annual Meeting will be a virtual meeting, which will be conducted via live webcast. In order to attend the Annual Meeting, you must register at http://www.virtualshareholdermeeting.com/PMN2025. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the Annual Meeting and to vote and submit questions during the Annual Meeting. There will not be a physical meeting location, and shareholders will not be able to attend the Annual Meeting in person. Further information about how to attend the Annual Meeting online is included in this proxy statement below. Except where the context otherwise requires, references to “ProMIS Neurosciences,” “ProMIS,” “company,” “we,” “us,” “our” and similar terms refer to ProMIS Neurosciences Inc. and its consolidated subsidiaries.

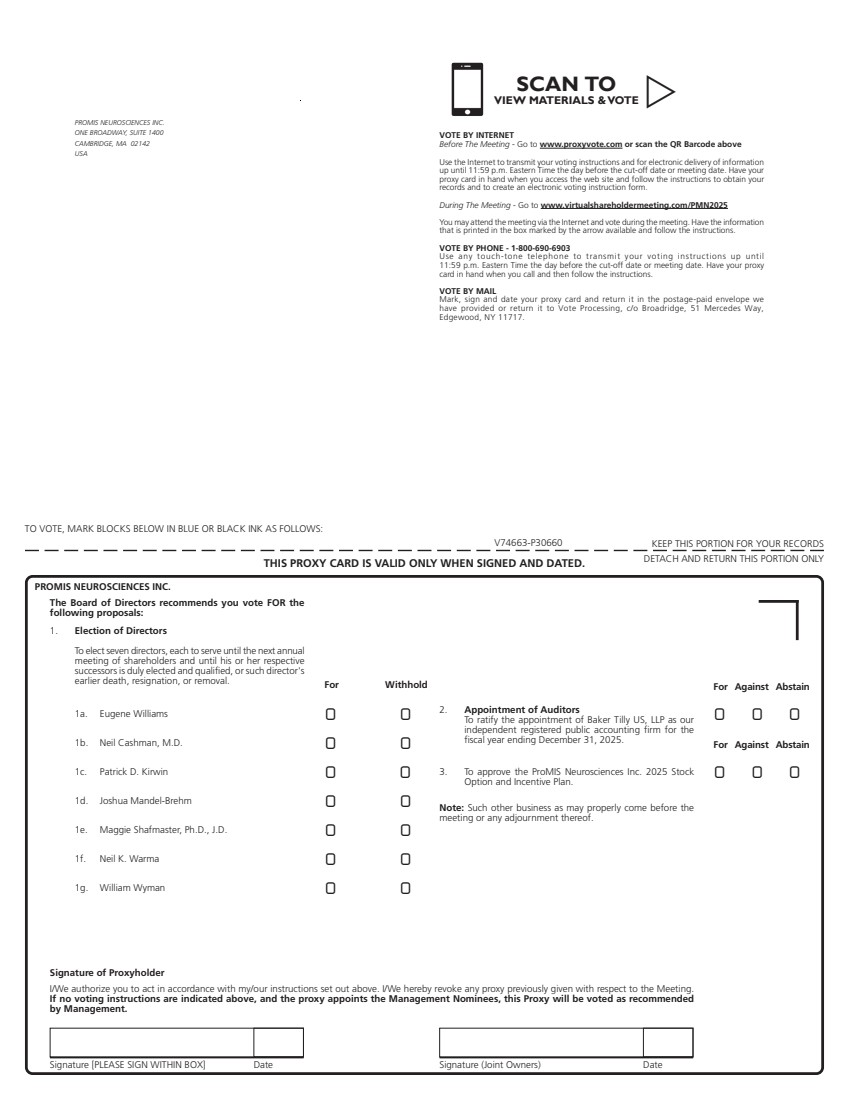

This proxy statement summarizes information about the proposals to be considered at the meeting and other information you may find useful in determining how to vote. We are making this proxy statement, the related proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (the “2024 Annual Report”), available to shareholders for the first time on or about April 29, 2025.

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”) and the Canadian Securities Administrators (the “CSA”), we are providing access to our proxy materials over the Internet instead of printing and mailing our proxy materials. As a result, we are mailing to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”), instead of a paper copy of this proxy statement and the 2024 Annual Report. We plan to send the Notice on or about April 29, 2025. The Notice contains instructions on how each of our shareholders may access and review the proxy materials, including the Notice of Annual Meeting, proxy statement, proxy card and 2024 Annual Report, on the website referred to in the Notice. The Notice also contains instructions on how each of our shareholders may request that a paper copy of our proxy materials, including this proxy statement, our 2024 Annual Report, and a form of proxy card, be sent to such shareholder by mail.

1